Abstract

Background: South African district municipalities supply, inter alia, basic social goods in order to realise socio-economic rights and promote sustainable development in their local communities. This requires adequate funding, which may be in the form of own generated revenue and intergovernmental transfers. However, despite legislated functions, many district municipalities are regarded as financially distressed and unable to deliver on their constitutional mandates.

Aim: This study sought to develop a sustainable differentiated funding model for district municipalities that will enable them to deliver on their constitutional mandates.

Methods: This empirical study followed a positivist paradigm and used questionnaires to solicit the views of selected municipal officials from all district municipalities on the efficacy of the current funding model against the key principles that underpin a successful funding framework for South African municipalities.

Results: The results of this study indicated that the funding district municipalities receive and generate is not in line with their constitutional mandates, which in turn, negatively affects their financial condition. Thus, there is a necessity to reconstruct the current funding model.

Conclusion: This study recommends a clear specification of C1 and C2 district municipal powers and functions, and that the current funding model change from applying a blanket approach and rather consider the different geographical areas and circumstances for C1 and C2 district municipalities.

Contribution: This empirical study contributes to the broader body of scientific knowledge on the local government financial governance by addressing the funding model for South African district municipalities in a practical manner.

Keywords: basic social goods; constitutional mandates; financial condition; funding model; municipal revenue; socio-economic development; South Africa; sustainable development.

Introduction and background

Chapter 1 of the Constitution of the Republic of South Africa (RSA) (1996) accords everyone the right to have their dignity respected and protected by recognising human dignity as one of the values, which the latter South African Constitution enshrines. In line with the constitutional values in chapter 1, the Bill of Rights in chapter 2 of the constitution affirms these values, by enshrining the right of every citizen, inter alia, to human dignity. Liebenberg (2005) analyses the manner in which human dignity may be used to elucidate and classify several rights in the Bill of Rights as socio-economic rights. Brand and Heyns (2005:3) aptly encapsulate the definition of socio-economic rights ‘as rights which entitle every citizen to corporeal commodities essential for them to live in’conditions consistent with human dignity’, in other words, environmental rights and the rights to education, food, healthcare, housing, social security, and water (Khoza 2007).

Encompassing socio-economic rights in the Bill of Rights asseverates the significance of corporeal conditions in human survival and development in local communities (Liebenberg 2005). According to section 7(2) of the Constitution (RSA 1996), the government is impelled to take cognisance of, preserve, advocate, and realise socio-economic rights as part of its constitutional mandate. This constitutional mandate suggests that national government bears the responsibility to take positive action, such as supplying basic social goods, which corroborates the progressive promotion of socio-economic and sustainable development, in response to the constitutional mandate on socio-economic rights (Ngang 2014). Josie (2011) asserts that municipalities, acting as representatives of national government, are the primary sites for the promotion of socio-economic and sustainable development. In other words, municipalities must plan, finance and implement programmes that will give effect to the foregoing constitutional mandates.

Although these constitutional mandates may seem realisable, in reality many municipalities are unable to fulfil them because of their poor financial condition (Mphahlele & Zandamela 2021). District municipalities are no exception. The need for, and strategic role of district municipalities was raised in March 1998 when the White Paper on Local Government was published. The 1998 White Paper contended that many boundaries have divided local communities irrationally; thus, there was a necessity to create district municipalities that would recognise the linkages between urban and rural communities (RSA 1998). Palmer (2011) identified two types of district municipalities: (1) those that do not provide bulk water services (C1) and (2) those that supply bulk water services, also known as Water Services Authorities (WSAs) (C2).

The funding model for district municipalities has received no attention and their financial predicament remained unresolved for many years (FFC 2022). For instance, in August 2021, the Department of Cooperative Governance and Traditional Affairs (CoGTA) reported eight district municipalities (18%) as being dysfunctional, indicating that five of these were under administration owing to poor governance (Financial and Fiscal Commission/FFC 2022). Furthermore, in the financial year 2018–2019, 163 South African municipalities were regarded as being financially distressed – 27 (61%) of which were district municipalities (National Treasury 2019). In line with these challenges, Mishi, Mbaleki and Mushonga (2022) latterly affirmed that district municipalities experience revenue inadequacy because of the growth in expenditure that surpasses the estimated budget and planned outlays.

This situation, together with poor financial governance, gives rise to financial deficits and ultimately, financial distress (Mishi et al. 2022). The question therefore arises: Can a sustainable differentiated funding model be developed that will enable South African district municipalities to fulfil their constitutional mandates? In reply to this question, the current empirical study sought to develop and propose a sustainable differentiated funding model for South African district municipalities that will enable them to deliver on their constitutional mandates. The following section presents the guiding theory for this study and the literature review of past studies. Thereafter, the research methodology used in the study is discussed, followed by the empirical results, and the conclusions and contribution of the study.

Theoretical framework

This study adopted the theory of the Five Capitals Model that was developed by an organisation known as the Forum for the Future, founded by the United Kingdom of Great Britain and Northern Ireland (UK) environmental guru Jonathan Porritt in 2018 (Binns 2018). The theory is based on so-called ‘capitals’ (resources), which are the elements that are needed for any sphere of government to be able to deliver sustainable public services. The concept of ‘capital’ has several different meanings. Therefore, it is useful to differentiate between the five kinds of capital: natural, human, social, manufactured, and financial capital. Firstly, these are natural capital (also sometimes referred to as environmental or ecological capital), which refers to the natural resources that are extracted from nature to be used by governments in different development activities, such as the provision of public services to local communities (Chen & Wang 2020). Secondly, human capital, which is very much a social issue. Human capital incorporates the health, knowledge, skills, intellectual outputs, motivation, and capacity for relationships of individuals (Chen & Wang 2020). In the absence of a suitably educated and trained workforce, for example, it will be impossible for most governments to function. Thirdly, capital is social capital, which refers to the resources and capabilities derived from the structures, relationships, and networks that government is linked to. Social capital influences information exchange and sharing, as well as the sharing of facilities and resources (Binns 2018; Chen & Wang 2020; Klinz 2011). Fourthly, capital is manufactured capital. Binns (2018) argues that it is pointless for government to have raw materials from nature, a well-trained and healthy workforce, and structures in place to communicate, if they do not have quality goods and the infrastructure needed to turn the raw materials into a product. Fifthly, capital is financial capital, which is related to the actual physical liquid cash and how it is used in the implementation of different government projects (Mhlanga 2019). It is therefore that financial condition is measured by the extent to which government managers can continuously accomplish their activities, such as the supply of basic social goods, without exhausting the existing financial resources. The concept of ‘financial condition’ has been observed by Wang, Dennis and Tu (2007) to have four associated dimensions of solvency, namely cash solvency, budget solvency, long-run solvency, and service-level solvency.

Mhlanga (2019) maintains that one of the captious determinants that strongly influences the enhancement of financial conditions in governments, which is a financial capital aspect, is the linkage of the notion of financial condition to the concept of sustainable development. According to Binns (2018), the definition of sustainable development was first developed by Gro Harlem Brundtland in 1987 in the publication ‘Our common future’, and although 1987 is a fair way back, it still holds true today. Essentially this definition looks at ‘needs’ as consisting of three factors that have to be balanced both now and, in the future, – social, environmental, and economic factors. For example, there cannot be a strong economy without considering the living standards of people and causing widespread environmental destruction in local communities. At some point in the future, such local communities would not be able to function, meaning that such an economy would not be sustainable. In the South African context, an unsustainable local community would also be a violation of the provisions made in chapter 1 of the Constitution (RSA 1996), such as human dignity, the achievement of equality and the advancement of human rights and freedoms. In the theory of Five Capitals Model, it is repeatedly stated that sustainable development is determined by the extent to which a government can execute several different programmes, such as the supply of basic social goods, without debilitating the source of capital.

Literature review

A considerable amount of literature argues that the current funding model for South African district municipalities is not responsive to their constitutional mandates. This is because there are differences between the district municipalities’ available financial resources and the actual expenditure requirements (Chauke 2016; Chitiga-Mabugu & Monkam 2013; Glasser & Wright 2020; Maphalla 2015; Mhlanga 2019). Enwereji and Potgieter (2018) confirm that these differences within the funding model are expanding because the self-generated municipal revenue of some South African district municipalities has declined.

District municipalities are mandated by the constitution to provide basic social goods required for the promotion of socio-economic and sustainable development in local communities. This study only focusses on the basic social goods that pose a threat to human dignity if not provided, which directly affect the quality of life, namely electricity, sanitation, waste removal, and water. The aggregated municipal revenue found within the funding model for district municipalities is intended to finance their operational and capital aggregated expenditure and to provide basic social goods. The municipal revenue-raising arrangements for district municipalities have been sourced through: (1) service charges, (2) former RSC levies, and (3) receiving intergovernmental transfer grants from national and provincial governments.

Service charges constitute a significant source of municipal revenue-raising arrangement of about 20% (on average) in South Africa (FFC 2022). Intergovernmental transfer grants are the primary source of about 75% (on average) of the municipal revenue-raising arrangements (FFC 2022). External sources available for district municipalities to finance municipal infrastructure is borrowing from the financial markets, which finances almost 5% on average of district municipalities’ budgets (Chitiga-Mabugu & Monkam 2013).

District municipalities receive their equitable share transfer to fund the supply of municipal health services (Ajam et al. 2021; Nzama 2019). This absence in municipal revenue generation capacity, however, makes them significantly dependent on intergovernmental transfer grants as their primary source of revenue. Currently, the Regional Services Council (RSC) levy replacement grant is funding almost 25% of district municipalities’ budgets (FFC 2022). The RSC levy replacement grant was introduced in 2006 as a temporary replacement of the RSC and Joint Services Board levies that were abolished in June 2006. Although the grant was established as a temporary measure while a suitable replacement was being sought, it has lasted for longer than many subsequent intergovernmental grants. The RSC levy replacement grant has been criticised for exhibiting glaring biases in the manner that it is allocated and distributed across C1 and C2 district municipalities because the allocation and distribution are not objective. The allocation is primarily based on the amount of levy income district municipalities were raising at the time of the RSC levies (Palmer 2011).

Therefore, the funding model for South African district municipalities is not responsive to the constitutional mandates, especially with regard to the RSC levy replacement grant, because it is based on a historical aspect that does not cater for the different contemporary realities of district municipalities. Thus, the allocation is not driven by any objective or modern criteria.

De Villiers (2008) and the United Nations Development Programme (UNDP 2012) point out several key principles that underpin a successful funding framework for South African municipalities, with only four being particularly relevant to district municipalities: (1) effective decentralisation and local independence require appropriate fiscal autonomy, (2) the funding of district municipalities must be in line with their constitutional mandates to safeguard their financial condition, (3) all functions assigned by national and provincial government to district municipalities must be accompanied by the necessary funding based on full and fair costing and (4) the intergovernmental transfer grants from national and provincial government to district municipalities must be unconditional and not aimed at any one project only.

Aswanth-Kumar (2014), Kumar and Reddy (2019), Mbandlwa, Dorasamy and Fagbadebo (2020) and Mditshwa (2020) argue that some of the foregoing key principles have not been adopted, as district municipalities are not receiving an equitable share of national revenue commensurate with their constitutional mandates. Mello (2018) and Munzhedzi (2020) are in congruence with the view held by the above-mentioned scholars that most district municipalities are not performing their constitutional mandates at the required level expected by legislation, because of their current funding model. Therefore, the adequacy of the funding model for district municipalities is a concern.

Research methods and design

Research methodology is the ‘methods, techniques and procedures that are employed in the process of executing the research design’ (Babbie & Mouton 2001:647). This study followed a positivist paradigm, with a quantitative research design, using descriptive correlational analysis to develop and propose a sustainable differentiated funding model for South African district municipalities that will enable them to deliver on their constitutional mandates. Williams (2007) posits that the descriptive correlational research design is a general plan employed to examine a situation as it exists in its current state. This research design involves identifying the attributes of a particular phenomenon (current funding model) based on an observational basis or the exploration of correlation between two or more phenomena.

Sample selection

The population consisted of 44 district municipalities, which is a representative sample of 100% of the district municipalities throughout all nine provinces in South Africa. The researcher designed the self-administered questionnaire, which consisted of close-ended questions and one open-ended question and sent them electronically to 44 targeted participants (accounting officers and chief financial officers [CFOs]) who were purposefully selected because they were believed to be knowledgeable and were directly involved with the funding model for the district municipalities.

Data collection and analysis

The questionnaire had five sections.

Section A focussed on the demographic profile of the research participants, such as their highest level of qualification, their position in the district municipality, and their time in service. This provided a picture of the respondents.

Section B aimed to establish the research participants’ perceptions regarding the funding framework for South African municipalities. The participants were required to rate the selected four statements: (1) effective decentralisation and local independence require appropriate fiscal autonomy, (2) the funding of district municipalities must be in line with their statutory obligations to safeguard their financial condition, (3) all functions assigned by national and provincial government to district municipalities must be accompanied by the necessary funding based on full and fair costing, and (4) the intergovernmental grants transfer from national and provincial government to district municipalities must be unconditional and not aimed at any one project only. A five-point Likert-type scale was used, as follows: 5 (extremely relevant), 4 (very relevant), 3 (of moderate relevance), 2 (of little relevance), and 1 (not relevant).

In section C of the questionnaire, the research participants’ perceptions of the current funding model for South African district municipalities were sought. Accordingly, the research participants were asked to indicate their agreement or disagreement with different assertions regarding the abolishment of the RSC levies, dependency on intergovernmental transfer grants, financial challenges faced by district municipalities, the municipal revenue-raising arrangements, inadequate revenue sources, the RSC levy replacement grant, and the efficacy of the entire funding model for district municipalities. Again, a five-point Likert-type scale ranging from 5 (strongly agree) to 4 (agree), 3 (neutral), 2 (disagree), and 1 (strongly disagree) was used. The objective of this section was to find evidence that supported or refuted the arguments in the literature review about the current funding model for district municipalities being non-responsive to their constitutional mandates.

In section D of the questionnaire, the research participants’ perceptions regarding the solvency factors (cash, budget, long-run, and service level) that could affect the efficacy of the funding model for district municipalities were sought. Accordingly, the participants were asked to rate the components of the four dimensions of solvency associated with the current funding model for district municipalities. The components are the equitable share (unconditional grant), RSC levy replacement grant (unconditional grant), conditional grants, total expenditure requirements, other expenditure, total income excluding grants, special support for councillor remuneration and ward committees’ conditional grant (conditional grant), total debts (liabilities), remuneration for employees and remuneration for councillors. Again, a five-point Likert-type scale ranging from 5 (extremely relevant) to 4 (very relevant), 3 (of moderate relevance), 2 (of little relevance), and 1 (not relevant) was used. The objective of this section was to comprehend the extent to which the solvency factors may have an impact on the efficacy of the current funding model for district municipalities.

Contrary to the foregoing sections, section E of the questionnaire was an open-ended question, which afforded the research participants an opportunity to provide additional comments and/or suggestions on the funding practices of district municipalities. These suggestions could be used by the researcher to make recommendations for a newly reconstructed funding model for South African district municipalities.

Out of the 44 research participants, 34 (77.3%) completed and returned the questionnaires. The Statistical Software (STATA): Release 16 by StataCorp LLC in USA, was used to analyse and interpret the responses in sections B, C, and D. Nevertheless, prior to analysing the data from the questionnaires, the researcher exercised quality control by preparing and capturing the data on Microsoft Excel spreadsheets. Subsequently, the researcher imported the documents into the STATA software for coding and ultimately data analysis.

Ethical considerations

Ethical clearance to conduct this study was obtained from the University of South Africa College of Accounting Sciences Research Ethics Review Committee (No. 2022_CAS_031).

Empirical results and discussion

This section presents the descriptive statistics of the variables used in the analysis, the correlation coefficients, and the derived results.

Data management, validity, and reliability test

Construct validity was obtained by formulating self-administered questionnaires from the reviewed literature. The questionnaire was submitted to the Unisa College of Accounting Sciences’ research ethics review committee (RERC) for approval, prior to distribution thereof to the research participants. Validity was further maintained by ensuring that the questionnaires were administered only to accounting officers, chief financial officers (CFOs) or senior financial managers in the 44 district municipalities who are believed to possess specific characteristics that are of relevance to the study.

The study data management involved relabelling the questions and recoding the selected options between 1 and 5 to 0 and 4, which is categorical and more appropriate for the analysis. Prior to the analysis of the questionnaire, a reliability test was conducted. From the population, a sample of 34 observations was used. A reliability test was conducted to examine the consistency of the respondents in each variable, using Cronbach’s alpha. The reliability test shows greater consistency as the scale reliability coefficient moves close to 1. In this case, the value was 0.8087. The items that had a negative sign were omitted. The negative sign might be explained by outliers and using Cronbach’s alpha reliability test to identify responses that may not be reliable (see Table 1–A1).

Study variables

The only independent variable for this study was the question in the questionnaire, which required the research participants to indicate the status of their district municipality (DM) – a C1 or a C2. The dependent variable was constructed from a series of five Likert-type scale questions to form a financial condition variable. The histogram of the outcome variable of the funding model for C1 and C2 district municipalities is shown in Figure 1. From the information in Figure 1, it is evident that they are not the same.

|

FIGURE 1: Histogram of the funding model for: (a) C1 and (b) C2 district municipalities. |

|

Construction of financial condition and funding model

A multiple correspondence analysis (MCA) was used in the study to generate an index of cash solvency, budget solvency, long-run solvency and service-level solvency, as well as the current funding model index, from categorical variables. While the MCA is appropriate for the construction of categorical variables, principal component analysis (PCA) is appropriate for the continuous variable (Adediran, Fakoya & Sikhweni 2021). Furthermore, a financial condition index was created from the set of continuous variables using PCA. The results of the MCA outcomes were divided into two sections. The first section revealed that the normalised principal inertia, and the cumulative percentage is 97.82 at the first dimension. The second section presented the coordinate column under the first dimension as negative (see Table 1–A2 for the MCA and PCA output). However, to correct the error of the negative sign in the coordinate column, the predicted index was multiplied by minus one (-1) to get the appropriate outcome (see Table 1). Therefore, the mean and the standard deviation of the index generated were zero and one, respectively.

Table 1 presents the summarised statistics of the key variables. All the variables were continuous after the creation of indices, except for the district municipality status, which was categorical. The financial condition had a minimum and maximum of –1.44 and 0.74, respectively. The funding model variable had a minimum of –0.51 and a maximum of 1.04.

Section A analysis

Table 2 presents a summary of the demographic information of the research participants.

| TABLE 2: Demographic information of the research participants. |

As Table 2 indicates, 24% of the research participants held a higher diploma or first degree, followed by an honours degree (38%), and master’s degree (26%). The remainder of the research participants held doctoral degrees (12%). This suggests that the research participants included in the study had tertiary educational backgrounds and were able to provide reliable information about the current funding model for district municipalities and its responsiveness to their constitutional mandates. Furthermore, the majority (62%) of the research participants included in the study were accounting officers (also referred to as municipal managers), followed by CFOs (38%). This implies that the research participants included in this study had relevant expertise and the information they provided could be considered reliable.

However, it is important to observe that no other senior financial managers participated in this study. Table 2 also indicates that the majority of the research participants 15 (44%) were in service for between 11 years and 20 years, followed by 11 (32%) of the research participants who had between 21 years and 30 years of service, and 8 (24%) who had between 0 years and 10 years of service. This indicates that the research participants were experienced and had the skills and expertise to provide reliable information.

Sections B to D analysis

Table 3 presents the funding model and financial condition, using paired t-testing, for South African district municipalities.

| TABLE 3: Funding model and financial condition using a paired t-test. |

Both the funding model and the financial condition of district municipalities were considered from the responses of the research participants. A paired t-test was used to investigate the relationship between the financial condition and funding model of each district municipality. The results indicate the differences in the values of the financial condition and funding model of the district municipalities and examine if the mean of these differences is equal to zero. The t-statistic was 1.17, with a df of 33. The findings show that the mean difference between the financial condition and funding model is 0.21, which is different from 0. The probability (p-value) of the paired t-test was 0.89. These results imply that there is a difference between the funding model and the financial condition of South African district municipalities. Undoubtedly, this is evidence that the current funding model for South African district municipalities is not responsive to their constitutional mandate.

Furthermore, we tested whether there is a significant difference in the financial condition between C1 and C2 district municipalities. Table 4 presents the findings.

| TABLE 4: Financial condition of C1 and C2 district municipalities using a two-sample t-test with equal variances. |

A two-sample t-test with equal variances was used, comparing the mean of the variable between the two statuses (C1 and C2) of the district municipalities. The study compared the means of the financial conditions of the C1 and C2 district municipalities. The mean of C1 district municipalities is negative (–0.022), and the mean of C2 district municipalities is positive (0.025). The difference between the C1 and C2 district municipalities is –0.048. The t-statistic is –0.14 and the degrees of freedom is 32. The corresponding two-tailed p-value is 0.892, which is greater than 0.05. The difference in means of financial condition between the C1 and C2 district municipalities is different from 0. The result reveals that there is a difference in the financial conditions of C1 and C2 district municipalities.

Moreover, the study investigated whether there is a statistically significant difference in the funding models of C1 and C2 district municipalities. Table 5 presents the results.

| TABLE 5: Financial model of C1 and C2 district municipalities using a two-sample t-test with equal variances. |

The study used a two-sample t-test with equal variances that compared the means of the variables of the two groups. The combination of all the funding models for district municipalities had a mean of –0.21. The result implies that all C1 and C2 district municipalities are at a disadvantage when it comes to their funding models. They are therefore likely to be at a financial deficit in their statement of profit or loss and other comprehensive income.

Furthermore, the means of the funding models of the C1 and C2-status district municipalities were compared and the difference was 0.052. The t-statistic was 1.196 and the df was 32, while the mean of C1 district municipalities was –0.18, and that of C2 district municipalities was –0.24. Hence, the means of the funding models of both the C1 and C2 district municipalities were negative. The corresponding two-tailed p-value was 0.241, which is greater than 0.05. The result implies that there is a difference in the funding models of C1 and C2 district municipalities.

The foregoing empirical results from sections B, C and D of the questionnaire are consistent with the findings of the scholars cited in the literature review (e.g., Chauke 2016; Chitiga-Mabugu & Monkam 2013; Glasser & Wright 2020; Maphalla 2015; Mello 2018; Monkam 2014; Mphahlele & Zandamela 2021; Munzhedzi 2020), who all asserted that the current funding model for district municipalities is flawed and not responsive to their constitutional mandates.

Section E analysis

Some participants provided the following additional comments pertaining to the current funding model for South African district municipalities:

- The demarcation of wall-to-wall municipalities affected the revenue-generating capabilities of district municipalities through levying of property rates, which was taken away as well as through the district management areas that have been assigned to local municipalities. District municipalities do not have revenue-generating capabilities such as property rates and consumer services, unlike in the past when the farms were billed for rates and taxes by district municipalities. The transfer and principle of wall-to-wall municipalities has in essence drained the financial or revenue-generating capabilities of district municipalities.

- District municipalities are not able to apply for Municipal Infrastructure Grant (MIG) funds although the powers and functions make provision for the bulk provision of services.

- The then Minister and Members of the Executive Council (MECs) assigned the bulk water services authority functions to local municipalities, which has a direct impact on the equitable share contribution. The ability to raise alternative revenue can thus not be achieved through the disjuncture of this assigned function.

- The effects of sharing functions, such as fire-fighting services, with local municipalities on the funding is uncertainty in terms of long-term planning and the costs duplication for each tier, which is not favourable.

- There is a misalignment between the assigned functions of district municipalities and the necessary funding, as a result, district municipalities are compelled to take on unfunded mandates.

- The funding allocation for the assigned functions is not sufficient and results in a prioritised model where some functions are neglected.

- District municipalities are also faced with the challenge of MECs responsible for local government in each province who have adjusted and re-adjusted their powers and functions to local municipalities over many years. The adjustment is mostly related to the bulk service supply of water. As a result, district municipalities lose their funding for bulk infrastructure.

These views of the research participants on the funding practices of district municipalities concurred with the results from the paired t-tests discussed here. District municipalities are primarily funded through the RSC levy replacement grant, and the allocation of this funding is not driven by any purpose or objective like conditional grants. Instead, the allocation is primarily based on the quantum of levy income district municipalities were raising at the time of the RSC levies. The research participants stressed the fact that the allocation of funding is not aligned with the powers and functions of district municipalities as stipulated in section 84(1) of the Municipal Structures Act (No. 33 of 2000) (RSA 2000). The findings support the results obtained by Aswanth-Kumar (2014), Kumar and Reddy (2019), Mbandlwa et al. (2020) and Mditshwa (2020), who found that district municipalities are not receiving funding from national government commensurate with their constitutional mandates. In the same light, the findings of a study undertaken by the FFC (2022) on district municipalities, ‘Powers, functions, and funding framework’, revealed that the current funding model for district municipalities is not synchronised with their constitutional mandates.

Furthermore, the research participants mentioned that the two-tier local government system governing local and district municipalities also affects their funding model adversely. This is attributable to the fact that the powers and functions of the district municipalities overlap with those of local municipalities in the district areas, more so because the MECs can adjust the powers and functions within this two-tier local government system. This is in congruence with the findings of the FFC (2022), which revealed that the division of powers and functions between district and local municipalities results in funding not following function. A case in point are fire-fighting services, which are funded through the equitable share. In many instances, when district municipalities perform this function, local municipalities do not transfer the equitable-share allocations meant for this function (FFC 2022).

Lastly, the research participants mentioned that district municipalities do not have revenue-generating capabilities such as property rates and consumer services, unlike in the past, when the farms were billed for rates and taxes by district municipalities. There is therefore a necessity for another permanent revenue source, which will generate income for them like the RSC levies did.

The RSC replacement grant, which is not aligned to their functions, was intended to be a temporary source of revenue. Therefore, the analysis of the primary data suggests a need for a long-term sustainable funding model for South African district municipalities, which should be based on their powers and functions.

Limitations of the study

Although the large population of the study consisted of all 44 district municipalities, the ultimate sample size of 34 was relatively small, and thus could have limited the strength of the statistical analysis.

Contribution of the study

This study makes a practical contribution to the discourse in the South African public sector on local government financial governance and the literature base, with a specific focus on the funding model for district municipalities, by expanding on research documenting the funding practices of district municipalities.

A proposed sustainable differentiated funding model

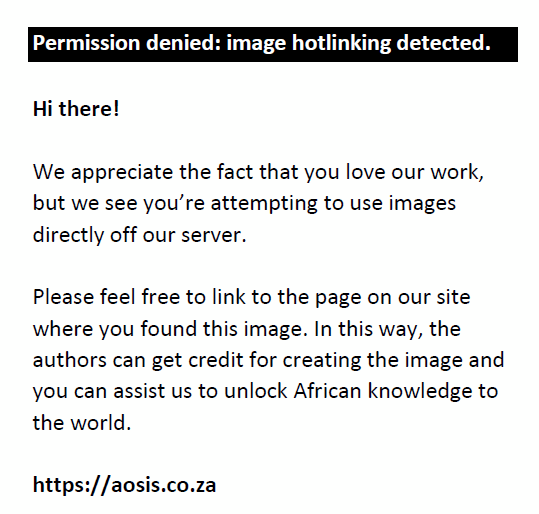

Based on the multiple correspondence analysis of the questionnaire responses, the empirical results could be contextualised and have led to the development of a sustainable differentiated funding model for district municipalities, as part of the Local Government Fiscal Framework (LGFF). The LGFF is defined by the FFC (2012) as the funding arrangement required to ensure that municipalities are sufficiently financed to fulfil their constitutional mandates to render adequate services to their local communities. The developed sustainable differentiated funding model is depicted in Figure 2.

|

FIGURE 2: A sustainable differentiated funding model for C1 and C2 district municipalities. |

|

Figure 2 is a graphical presentation of a renewed and reconstructed funding model for South African district municipalities because the current funding model has been criticised for not being responsive to the constitutional mandates of C1 and C2 district municipalities. Importantly, the findings of the extant literature on the current funding model for South African district municipalities have been corroborated by the empirical results of this study. As a result, improvements have been explicitly determined and have been incorporated in the developed sustainable funding model for South African district municipalities. They are discussed hereafter.

The refined and clear specification of C1 and C2 district municipal powers and functions

The findings from the analysis of the responses in the questionnaire revealed that the current funding model for district municipalities is inadequate because of the unclear specification of the legislated powers and assigned functions of district municipalities and the local municipalities in those district areas. This results in a misalignment of the assigned functions of the district municipalities and the allocated funding, as well as their financial or revenue-generating capabilities.

This is because the MECs of the local government in every province have unfettered discretion to transfer functions between district and local municipalities, or vice versa. Of major concern is that no set criteria are applied in such adjustments. It is therefore that the developed sustainable differentiated funding model (hereinafter referred to as ‘The developed funding model’) depicted in Figure 2 suggests that for C1 and C2 district municipalities to fulfil their constitutional mandates, the most important and initial aspect is the clear specification of their powers and functions in relation to those of the local municipalities, and the alignment of the funding to the assigned functions. This is clearly in line with the key principles of a funding model for municipalities as identified by De Villiers (2008) and the United Nations Development Programme (UNDP 2012).

The recognition of the tax base splits among C1 and C2 district municipalities

Moreover, the current funding model for district municipalities applies a blanket approach1 to all C1 and C2 district municipalities. Thus, the current funding has the weakness of not taking into consideration the different localities and circumstances of the various C1 and C2 district municipalities. This is confirmed in a considerable amount of literature (Ajam et al. 2021; Monkam 2014; Mphahlele & Zandamela 2021; National Treasury 2022). It is for this reason that the developed funding model acknowledges the fact that C1 and C2 district municipalities exist in different localities, such as rural areas or towns, with distinct circumstances, particularly regarding their tax bases.2 A blanket approach is therefore clearly not appropriate for all C1 and C2 district municipalities. For instance, some district municipalities situated in towns may have local communities with a strong tax base, who may be able to afford to pay for the provision of basic social goods, whereas other communities may not.

The restructured municipal revenue-raising arrangements for C1 and C2 district municipalities

For C1 and C2 district municipalities to exercise such a clear specification of their legislative powers and assigned functions, there must be financial resources available, which must have been arranged prior to them exercising their powers and functions. In the current funding model for district municipalities, the funding is financed from municipal revenue-raising arrangements stemming from non-exchange transactions, exchange transactions, as well as municipal borrowings to enhance their financial condition. Palmer (2011) posits that revenue from non-exchange transactions such as intergovernmental transfer grants, fines, penalties, and donations constitutes about 75% on average of municipal revenue-raising arrangements for district municipalities. FFC (2022) also observe that revenue from exchange transactions such as service charges, agency fees, interest income, and rental income constitutes a significant source of municipal revenue-raising arrangements, of about 20% on average for district municipalities in South Africa. On the one hand, Chitiga-Mabugu and Monkam (2013) affirm that one of the external sources of revenue available for district municipalities to finance municipal infrastructure is borrowing from the financial markets, which constitutes about 5% on average of municipal revenue-raising arrangements.

Although there are municipal revenue-raising arrangements in place, with the purpose of assisting district municipalities to fulfil their constitutional mandates, prior studies (e.g., Chauke 2016; Chitiga-Mabugu & Monkam 2013; Glasser & Wright 2020; Maphalla 2015; Mhlanga 2019; Mishi et al. 2022) and the empirical findings of this study (e.g., the paired t-test on the funding model and financial condition and the two-sample t-test with equal variances on the funding model and financial condition) have demonstrated that C1 and C2 district municipalities do not have adequate revenue-generating capabilities, unlike in the past when farms (agricultural land) were billed for rates and taxes. It is therefore that the developed funding model discards the blanket approach of the existing funding model for district municipalities. Instead, it puts forward the restructuring discussed next, for consideration.

C1 district municipalities

Revenue from non-exchange transactions for C1 district municipalities

The developed sustainable differentiated funding model suggests that C1 district municipalities with a minimal tax base should be entitled to revenue from non-exchange transactions, which should constitute about 98% on average of their municipal revenue-raising arrangements, rather than the current 75% observed by Palmer (2011). On the contrary, C1 district municipalities with a maximal tax base should collect their revenue from non-exchange transactions, which should constitute about 60% on average of their municipal revenue-raising arrangements. This is because C1 district municipalities are not WSAs and do not provide bulk water and sanitation services to their local communities, unlike C2 district municipalities, who generate most of their municipal revenue from the supply of bulk water services.

Furthermore, as depicted in green in Figure 2, the developed funding model suggests that the allocation of the RSC levy replacement grant, which currently exhibits glaring biases in its distribution across district municipalities and is blamed for being regressive, should be based on a formula of the district municipality’s population of indigent people and its size, regardless of whether the C1 district municipality has a minimal or maximum tax base. This is because it was observed in the literature reviewed, that district municipalities rely heavily on the RSC levy replacement grant as their primary source of funding. Thus, a fair allocation of the RSC levy replacement grant would enhance the financial condition of C1 district municipalities.

In order to further ensure that the financial condition of C1 district municipalities is enhanced, the developed funding model also puts forward that, in addition to the available municipal revenue-raising arrangements such as the unconditional and conditional transfer grants, self-generated revenue, and municipal borrowings, all C1 district municipalities with minimal as well as maximal tax bases should also be allocated a share of the general fuel levy.3

Revenue from exchange transactions for C1 district municipalities

The developed funding model further propounds that revenue from exchange transactions for C1 district municipalities with a minimal tax base be adjusted to 2%, rather than the current 20% observed by FFC (2022). This is because C1 district municipalities do not supply bulk water services from which they could generate revenue. Hence, their sources of revenue from exchange transactions such as agent fees and interest income are minimal, particularly for those situated in rural areas. If the recommendations of the developed funding model were to be adopted, C1 district municipalities with minimal and maximal tax bases could receive 98 and 60% funding, respectively, from intergovernmental transfer grants, which undoubtedly could be adequate to meet their constitutional mandates.

Additionally, the developed funding model also recommends that C1 district municipalities with a maximal tax base should be entitled to revenue from exchange transactions in the form of fire-fighting service charges, which should constitute about 30% on average of their municipal revenue-raising arrangements. This is because their powers and functions also make provision for, inter alia, fire-fighting services. Indisputably, the service charges generated from the provision of fire-fighting services could enhance the financial condition of C1 district municipalities with a strong tax base.

Municipal borrowing for C1 district municipalities

The developed funding model submits that C1 district municipalities with a minimal tax base should not be entitled to municipal borrowings, rather than the current 5% as observed by Chitiga-Mabugu and Monkam (2013). This is because the above-mentioned external sources of municipal revenue are meant to finance municipal infrastructure, and this could already have been covered by the proposed 98% funding stemming from the Schedule 4, Part B and Schedule 5, Part B infrastructure grant allocations (conditional grants).

On the other hand, the developed funding model advocates for C1 district municipalities with a maximal tax base to be entitled to municipal borrowings of about 10% on average of their municipal revenue-raising arrangements. This is because the developed funding model also provides for C1 district municipalities to generate revenue from exchange transactions in the form of fire-fighting service charges. Also, the ‘manufactured capital’ aspect of the study’s guiding theory, ‘The theory of five capitals model’, strongly holds that government (district municipalities) requires manufactured goods such as machines, equipment and tools to execute different government activities such as the provision of public services (constitutional mandates), in this case fire-fighting services. This confirms the importance of capital investment. Hence, the developed funding model advocates for C1 district municipalities with a maximal tax base to be entitled to some municipal borrowings to finance the acquisition of municipal infrastructure.

C2 district municipalities

Revenue from non-exchange transactions for C2 district municipalities

Importantly, even though C2 district municipalities could supply bulk water and sanitation services from which they are expected to generate revenue, it is not all C2 district municipalities that have local communities with a strong tax base who could afford to pay for basic social goods. It is for this reason that the developed funding model puts forward a higher percentage (77%) of intergovernmental transfer grants than the current 75%, observed by Palmer (2011), for C2 district municipalities with a minimal tax base. On the other hand, the developed funding model puts forward a lower percentage (27%) of intergovernmental transfer grants for C2 district municipalities with a maximal tax base. This is because of the assumption that customers in those local communities will be able to afford to pay for the water and sanitation services provided by the C2 district municipalities.

As for C1 district municipalities, the developed funding model also recommends that the allocation of the RSC levy replacement grant to all C2 district municipalities with minimal and maximal tax bases be performed by using a formula taking into account a C2 district municipality’s population of indigent people and its size. This is because the RSC levy replacement grant is the primary source of funding for all South African district municipalities. Certainly, the foregoing grant has the potential to enhance as well as safeguard the financial condition of C1 and C2 district municipalities if only the glaring biases identified by the literature and confirmed by this study’s empirical results, could be eliminated.

Moreover, it has emanated from the empirical findings of this study that district municipalities are not able to apply for the MIG (infrastructure) funds, even though their legislated powers and assigned functions make provision for the bulk supply of water services. District municipalities only administer MIG funds and manage MIG projects on behalf of those local municipalities in their district areas that do not have sufficient capacity. In light thereof, and as depicted in green font in Figure 2, the developed funding model recommends that all C2 district municipalities with minimal as well as maximal tax bases be entitled to an additional intergovernmental transfer grant in the form of MIG funding to ensure the bulk supply of basic social goods in a sustainable manner.

Revenue from exchange transactions for C2 district municipalities

The developed funding model also recommends that revenue from exchange transactions for C2 district municipalities with a minimal tax base remains the same (20%) as observed by FFC (2022). This is because, as mentioned before, even though C2 district municipalities may have the status of being WSAs and/or Water Service Providers (WSPs), unfortunately not all of them have potential customers (a strong tax base) who could afford to pay for basic social goods. Conversely, the developed funding model recommends a higher percentage (70%) of revenue from exchange transactions for C2 district municipalities with a maximal tax base. This they would earn from exchange transactions from the bulk supply of water services, which should constitute about 70% on average of their municipal revenue-raising arrangements.

Municipal borrowings for C2 district municipalities

The developed funding model propounds that all C2 district municipalities with minimal as well as maximal tax bases should be entitled to an external source of revenue in the form of municipal borrowings, which should constitute about 3% on average of their municipal revenue-raising arrangements, rather than the current 5% noticed by Chitiga-Mabugu and Monkam (2013). This is because the developed funding model recommends that C2 district municipalities with minimal tax bases be entitled to 77% of the intergovernmental transfer grants, which comprise different kinds of conditional grants aimed at financing capital investments (long-term physical assets). Furthermore, the developed funding model recommends that C2 district municipalities with maximal tax bases earn 70% of their self-generated revenue from the supply of bulk water services. Undoubtedly, this amount of municipal revenue could finance the capital budgets of these C2 district municipalities and enhance their financial condition.

Outsourcing revenue collection

To ensure that the finances of C1 and C2 district municipalities are adequate to allow them to fund their operational expenses in order to meet their constitutional mandates, the developed funding model draws on the findings of a study conducted by Fjeldstad, Katera and Ngalewa (2009) on ‘Outsourcing revenue collection to private agents: Experiences from local authorities in Tanzania’, and recommends that C1 and C2 district municipalities also make use of outsourcing services, particularly for the revenue from exchange transactions. The study concluded that outsourcing offers no quick fix to increase municipal revenue-raising or reduce tax administration problems. However, the study revealed that, when outsourcing is appropriately managed and monitored, then the outsourced revenue collection may establish a foundation for more effective and efficient municipal revenue-raising administration (financial governance). In addition to this, the district municipal revenue-raising arrangements from the non-exchange and exchange transactions need to be effectively and efficiently administered for C1 and C2 district municipalities to have financial resources available immediately and in the future to meet their constitutional mandates.

Other recommendations

It was found that there is an urgent need for the South African national government to review and amend section 84 of the Municipal Structures Act (No. 33 of 2000) to organise and simplify the division of powers and functions between district and local municipalities. This will make the proper appreciation of the situational context and interrelationship between district and local municipalities possible, and subsequently provide a clear link between the functions and the funding of those functions.

Furthermore, the current proposal by President Cyril Ramaphosa that places district municipalities as leading players in the District Development Model (DDM) is a concern. One would expect the DDM to be led by a strong and financially well-functioning institution. Therefore, it is important for the South African national government to intervene and adopt an improved funding model, as proposed in this study, to change the status quo of district municipalities and enable them to play the role as envisaged by the DDM and, most importantly, to meet their constitutional mandates.

Acknowledgements

The authors would like to thank the anonymous reviewers and all the editors involved in the process of manuscript revision.

Competing interests

The authors have declared that no competing interest exists.

Authors’ contributions

L.B.G. wrote the manuscript, analysed the data, and developed the model. L.J. supervised the research project by providing critical feedback and helped to shape the research, analysis and manuscript.

Funding information

This research received no specific grant from any funding agency in the public, commercial or not-for-profit sectors.

Data availability

The data that support the findings of this study are available from the corresponding author, L.B.G., upon reasonable request.

Disclaimer

The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any affiliated agency of the authors, and the publisher.

References

Adediran, O.A., Fakoya, M. & Sikhweni, N.P., 2021, ‘The causal effect of education policy on female’s decision-making in sub-Saharan Africa: Evidence from Nigeria: Evidence from Nigeria’, The Education Systems of Africa, 549–565. https://doi.org/10.1007/978-3-030-43042-9_36-1

Ajam, T., Burger, J., Quinot, G., Botha, M., Isaacs, D. & Douglas, J., 2021, Towards a municipal financial and operational sustainability strategy for the Western Cape: A report for the Western Cape Department of Local Government, viewed 08 July 2022, from https://www.sun.ac.za/english/faculty/economy/spl/SPL%20Library/SPL%202021%20unicipal%20Sustainability%20Report%20v2%202021-0606%20FINAL%20SMALL.pdf.

Aswanth-Kumar, K., 2014, ‘Narrowing the municipal funding gap: A metropolitan perspective in South Africa’, Master’s dissertation, University of Kwazulu-Natal.

Babbie, E. & Mouton, J., 2001, The practice of social research, Oxford University Press, Cape Town.

Binns, J., 2018, The five capitals – A model for sustainable development, RRC International, viewed 10 September 2022, from https://blog.rrc.co.uk/2018/07/30/the-five-capitals-a-modelfor-sustainable-development/.

Brand, D. & Heyns, C.H. (eds.), 2005, Socio-economic rights in South Africa, Pretoria University Law Press (PULP), viewed 07 July 2021, from https://www.pulp.up.ac.za/edited-collections/socio-economic-rights-in-South-Africa.

Chauke, K.R., 2016, ‘Municipal revenue collection function: A comparative study on the efficiency and effectiveness of Tshwane metropolitan municipality and the South African Revenue Service’, Doctoral thesis, University of Limpopo.

Chen, W.J. & Wang, C.H., 2020, ‘A general cross-country panel analysis for the effects of capitals and energy on economic growth and carbon dioxide emissions’, Sustainability 12(15), 5916. https://doi.org/10.3390/su12155916

Chitiga-Mabugu, M. & Monkam, N., 2013, Assessing fiscal capacity at the local government level in South Africa, Working paper 201376, University of Pretoria, Department of Economics, viewed 07 July 2022, from https://ideas.repec.org/p/pre/wpaper/201376.html.

De Villiers, B., 2008, Review of provinces and local government in South Africa: Constitutional foundations and practice, Konrad-Adenauer-Stiftung, Johannesburg, viewed 08 July 2021, from http://www.kasyp.net/fileadmin/kasyp_files/Documents/reused/documents/Review_of_povinces-kas.pdf.

Enwereji, P.C. & Potgieter, M., 2018, ‘Establishing a payment culture for municipal services in the Northwest Province: A conceptual framework’, International Journal of Economics and Financial Issues 8(3), 227–234, viewed 04 July 2022, from https://www.econjournals.com/index.php/ijefi/article/view/6177/pdf.

Financial and Fiscal Commission (FFC), 2012, Submission for the Division of Revenue 2013/14, Johannesburg, viewed 21 October 2022, from https://www.gov.za/sites/default/files/gcis_document/201409/submission-2013-14-division-revenue-3-pdf-reduced2.pdf.

Financial and Fiscal Commission (FFC), 2022, Submission for the Division of Revenue 2023/24, Johannesburg, viewed 10 September 2022, from https://www.ffc.co.za/_files/ugd/b8806a_eb1a481762d946a0a5177904c7189294.pdf.

Fjeldstad, O-H., Katera, L. & Ngalewa, E., 2009, Outsourcing revenue collection to private agents: Experiences from local government authorities in Tanzania, REPOA Special Paper No. 28, 2009 (April), Mkuni Na Nyota Publishers, Dar es Salaam.

Glasser, M.D. & Wright, J., 2020, ‘South African municipalities in financial distress: What can be done?’, Law, Democracy & Development 24, 413–441. https://doi.org/10.17159/2077-4907/2020/ldd.v24.17

Josie, M.J., 2011, ‘Accounting for economic disparities in financing municipal infrastructure in South Africa: A case study using data from the Cape Winelands district municipality’, Doctoral thesis, University of the Western Cape.

Khoza, S., 2007, Socio-economic rights in South Africa: A resource book, Community Law Centre, University of the Western Cape, viewed 08 July 2021, from https://repository.uwc.ac.za/xmlui/handle/10566/254.

Klinz, W., 2011, The importance of sustainable public finances, European Parliament Special Committee on the Financial, Economic and Social Crisis (CRIS), viewed 08 July 2022, from https://www.europarl.europa.eu/document/activities/cont/201109/20110901ATT25750/0110901ATT25750EN.pdf.

Kumar, K. & Reddy, P.S., 2019, ‘Metropolitan financing and development in South Africa: Quo vadis?’, Ghana Journal of Development Studies 16(2), 26–51. https://doi.org/10.4314/gjds.v16i2.2

Liebenberg, S., 2005, ‘The value of human dignity in interpreting socio-economic rights’, South African Journal on Human Rights 21(1), 1–31. https://doi.org/10.1080/19962126.2005.11865126

Maphalla, S.T., 2015, ‘Financial performance of local government: Evidence from South Africa’, MPhil dissertation, University of Stellenbosch.

Mbandlwa, Z., Dorasamy, N. & Fagbadebo, O, 2020, ‘Leadership challenges in the South African local government system’, Journal of Critical Reviews 7(13), 1642–1653. https://doi.org/10.31838/jcr.07.13.260

Mditshwa, S., 2020, ‘Socio-economic impact of public-private partnerships on rural development in the Eastern Cape Province: Selected cases’, Doctoral thesis, Cape Peninsula University of Technology.

Mello, D.M., 2018, ‘Monitoring and evaluation: The missing link in South African municipalities’, The Journal for Transdisciplinary Research in Southern Africa 4(1), 1–6. https://doi.org/10.4102/td.v14i1.409

Mhlanga, S., 2019, ‘A financial sustainability model for the South African local government’, Doctoral thesis, University of Fort Hare.

Mishi, S., Mbaleki, N. & Mushonga, F.B., 2022, ‘Financial mismanagement and efficiency trade-off in local municipalities: Lessons from Eastern Cape, South Africa’, Journal of Local Government Research and Innovation 3, a68. https://doi.org/10.4102/jolgri.v3i0.68

Monkam, N.F., 2014, ‘Local municipality productive efficiency and its determinants in South Africa’, Development Southern Africa 31(2), 275–298. https://doi.org/10.1080/0376835X.2013.875888

Mphahlele, M. & Zandamela, H., 2021, ‘Local government capacity development: A case study of a South African district municipality’, Journal of Public Administration and Governance, 11(2), 156–177. https://doi.org/10.5296/jpag.v11i2.18373

Munzhedzi, P.H., 2020, ‘Evaluating the efficacy of municipal policy implementation in South Africa: Challenges and prospects’, African Journal of Governance and Development 9(1), 89–105, viewed 07 July 2021, from https://journals.ukzn.ac.za/index.php/jgd/article/view/1534.

National Treasury, 2019, The state of local government finances and financial management, audit outcomes for the 2018/2019 financial year analysis document, viewed 24 July 2022 from http://mfma.treasury.gov.za/Media_Releases/The%20state%20of%20local%20government%20finances/Documents/02.%20SoLGF%20Report%2018_19%20-%2016%20October%202020.pdf.

National Treasury, 2022, Division of revenue bill, National Treasury, Pretoria, viewed 24 July 2022, from http://www.treasury.gov.za/legislation/bills/2022/[B6%20-%202022]%20(DoRB).pdf.

Ncanywa, T. & Mgwangqa, N., 2018, ‘The impact of a fuel levy on economic growth in South Africa’, Journal of Energy in Southern Africa, 29(1), 41–49. https://doi.org/10.17159/2413-3051/2018/v29i1a2775

Ngang, C.C., 2014, ‘Judicial enforcement of socio-economic rights in South Africa and the separation of powers objection: The obligation to take “other measures”’, African Human Rights Law Journal 14(2), 655–680, viewed 08 July 2021, from https://hdl.handle.net/10520/EJC165004.

Nzama, L., 2019, ‘Do poor financial performance indicators affect municipal grants budget allocation in South Africa?’, Journal of Reviews on Global Economics 8, 1514–1528. https://doi.org/10.6000/1929-7092.2019.08.135

Palmer, I., 2011, ‘An assessment of the performance of district municipalities’, in The first decade of the Municipal Demarcation Board – Reflections on demarcating local government in South Africa, The Municipal Demarcation Board, viewed 07 September 2022, from http://pdg.hambisana.com/wp-content/uploads/2022/03/Assessment-of-the-performance-of-district-municipalities.pdf.

Republic of South Africa (RSA), 1996, The Constitution of the Republic of South Africa, 1996, Government Printers, Pretoria.

Republic of South Africa (RSA), 1998, Local Government: The 1998 White Paper, viewed 07 March 2023, from https://www.gov.za/sites/default/files/gcis_document/201409/whitepaper0.pdf.

Republic of South Africa (RSA), 2000, Local Government: The Municipal Structures Act, No. 33 of 2000 as amended in 2000, viewed 05 June 2023, from https://www.gov.za/documents/local-government-municipal-structures-actRSA.

Stander, R., 2013, ‘The tax base of South African individuals: An International comparison’, Master’s dissertation, University of Pretoria.

United Nations Development Programme/UNDP, 2012, Local Governments in Southern Africa: An analytical study of decentralisation, financing, service delivery and capacities, CLGF/UNCDF//UNDP, New York, viewed 04 July 2022, from http://www.clgf.org.uk/default/assets/File/Publications/reports/Local_Governments_in_Southern_Africa_CLGF-UNCDF-UNDP2012.pdf.

Wang, X., Dennis, L. & Tu, Y.S., 2007, ‘Measuring financial condition: A study of US States’, Public Budgeting & Finance 27(2), 1–21. https://doi.org/10.1111/j.1540-5850.2007.00872.x

Williams, C., 2007, ‘Research methods’, Journal of Business and Economic Research 5(3), 65–72. https://doi.org/10.19030/jber.v5i3.2532

Appendix 1

Average interitem covariance: 0.1468911

Number of items in the scale: 58

Scale reliability coefficient: 0.8087

Test scale = mean(standardised items)

Appendix 2

Multiple correspondence analysis (MCA) for Funding model

Multiple or Joint correspondence analysis

Number of observations = 34

Total inertia = 0.39680353

Method: Burt or adjusted inertias

Number of axes = 2

| TABLE 1–A2: Multiple correspondence analysis (MCA) for funding model. |

| TABLE 2–A2: Statistics for column categories in principal normalisation. |

Footnotes

1. Refers to a broad strategy that applies equally to many, or all, situations, and is also known as a one-size-fits-all approach.

2. Tax base can be defined as the total amount of assets or revenue on which the government can levy a tax (Stander 2023). Within the context of municipalities, this refers to residents in local communities who can afford to pay municipalities for the provision of public services (basic social goods).

3. A fuel levy refers to an excise tax charged on petroleum products such as petrol, diesel and biodiesel, which is an important source of revenue for the government (Ncanywa & Mgwangqa 2018).

|